The results have been so positive that PUC-RS doesn't intend to stop and already has plans to automate processes with Dattos in other areas, check it out!

Processes managed by Dattos technology

- Accounts receivable - Hospital

- Accounts payable - Hospital

- Consolidated accounts receivable (trade bills and rents)

- Consolidated accounts payable

- Stocks PUC-RS

About PUC-RS

The Pontifical Catholic University of Rio Grande do Sul (PUC-RS) is one of the most traditional private higher education institutions of Brazil, with over 75 years of history in the country's education sector. The university offers 59 face-to-face undergraduate courses, as well as 10 online courses, 22 master's and doctoral degrees and hundreds of specializations.

In total, there are more than 40,000 active students and 170,000 professionals already trained by the institution. The team includes 2850 teachers and administrative staffas well as 2456 employees at Hospital São Lucasalso run by PUC-RS.

The PUC-RS Accounting team has a total of 20 people, including 10 are involved in account reconciliation processes accounting, tax, assets, accountability, etc.

Objective

View the company's extensive operations in the education and health marketsit's easy to imagine the the volume of information that this organization needs to process in its financial and accounting operations. Not to mention the human resources processes, considering payroll and benefits of the employees. more than 5,000 employees.

All this generated a a lot of manual work for the professionals responsible for reconciliations, crossing 15,000 lines from one file with another 15,000 lines from another filefor example, to carry out a reconciliation of accounts receivable.

Accounting is the company's central point of informationThe more agility you have in delivering the figures, the more demands you'll be able to meet and the more assertiveness you'll have in the process. So, what PUC-RS was looking for when it contacted Dattos was to automate as many processes as possible to win agility and security in the qualification of information for decision-making.

Challenges

Reconciliations were done manually using spreadsheets, resulting in a lot of operational hours for the team validating columns, and little time for more strategic analysis of pending issues.

The more operational demands there were, the less the accounting team was able to devote to analyzing discrepancies, resulting in less than desired delivery at the end of the month

Even with the high volume of data to be analyzed in the accounting routine, it was necessary to shorten reconciliation and analysis times and provide accurate information for decision-making

Solution

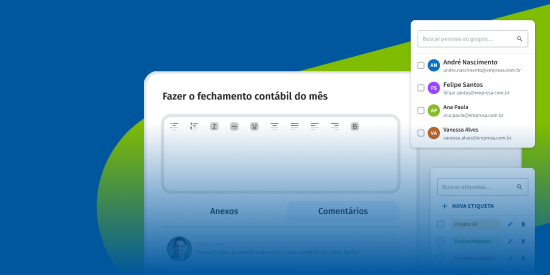

With the implementation of the Dattos Conciliation ManagementPUC-RS has succeeded automate a series of conciliation processes and save many operating hours over the month. The reduction was around 220 hours less spent by the accounting team in these processes, culminating in reconciliations Faster 90%.

The technology facilitates and automates the PUC-RS information cross-checking process by displaying pending issues directly on the screenwithout analysts having to spend hours looking for them.

As a result, the size of the divergence analysis spreadsheets has been reduced, as all the reconciled lines are excluded from this analysis, leaving only the pending ones. PUC-RS is now able to identify differences more quickly and find solutions to problems which were not possible with manual processes.

In addition, professionals perceive greater information security for being stored in the cloud and no longer handled manually. After all, Dattos registers a history of all activities carried outcontributing to process traceability.

Next steps

- Asset reconciliation

- Credit card reconciliation

- Reconciliation of agreements

- Accounts receivable - Academic Finance (Data Preparation module)