Payment Facilitator reconciliations

Ensure effective, centralized management of card receivables payment arrangement operations, mapping inconsistencies and errors in an automated way. Smoother, more accurate and transparent operations with acquirers, processors, card brands, registrars and merchants.

Fast and accurate

Reduce the time spent reconciling card receivables transactions. With Dattos, your team can identify and correct discrepancies quickly and efficiently, eliminating manual work and ensuring the accuracy of reported data. Our system allows for a complete reconciliation of payment arrangements, making the entire financial process more secure and auditable.

Complete integration

We map out the entire financial process, integrating all the parties involved - from the merchants to the processors - to maximize the advantages of automation. Our team of experts takes care of the entire implementation, ensuring that your team has complete autonomy in the management of receivables. Eliminate operational bottlenecks and have total confidence in the reconciled data.

Automated reconciliations between payment arrangement participants

Sub-purchaser vs. Purchaser

Contracted rates and discounts

Transactions reported by the acquirer and the fees to be passed on to it in accordance with the subacquirer's internal controls.

Chargebacks and reversals

Reconciliation of chargeback reports received from the acquirer with disputes and chargebacks managed internally by the sub-acquirer.

Settled payments

Comparison between the amounts settled in the bank accounts and the settlement reports provided by the purchaser.

Sub-buyer x Registrar

Receivables schedule

Assessment of discrepancies in the value of the receivable recorded in the registrar's schedule in relation to the sub-acquirer's schedule.

Contract effects

Verification of the claim made by the flag with what the sub-acquirer has recorded internally as an occurrence.

Verification of households and amounts settled

Evaluation between what has been paid and what appears on each household's bank statement.

Sub-buyer x Establishment

Fees for forward transactions

Checking that the current rates for forward transactions agreed in the contract with the merchants are being applied without financial loss to the sub-buyer.

Advance fees

Evaluation of the application of the current rates for anticipated transactions agreed in the contract with the CBs.

Advance payments

Comparison of the amounts anticipated in card transactions with the amounts actually credited.

PSP x Flag

Transactions captured by PSP x Flag

Confirm that the transactions reported by the payment processors are the same as those reported by the merchant.

Save time

Tasks that take days in Excel spreadsheets become tasks completed in minutes, freeing up time for analysis and other financial routines.

Trust the data

We map your entire process and integrate all endpoints. There's no room for error: reliable data, without the risk of manual mistakes, and quick identification of inconsistencies.

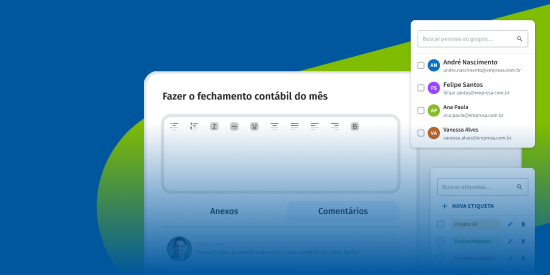

Real-time tracking

Configurable steps, deadlines, and responsibilities enable better task management and team visibility without micromanagement. Everyone stays aligned.

Optimize your routine

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks