Withholding tax reconciliation (IRRF, INSS, PIS/COFINS/CSLL)

Automate the reconciliation of withholding taxes (IRRF, INSS, PIS/COFINS/CSLL), ensuring that calculated amounts are correctly withheld and declared. Eliminate errors and improve tax management efficiency.

How does Dattos solve it?

Reconciliation accuracy

Dattos automates withholding tax reconciliation by cross-referencing accounting records with withheld amounts (IRRF, INSS, PIS/COFINS/CSLL). This ensures that all withholdings are correctly accounted for and in compliance with tax regulations.

Error elimination

Eliminate manual errors in the withholding process, preventing incorrect amounts or missing declarations. Dattos automatically identifies inconsistencies, ensuring full compliance with tax obligations.

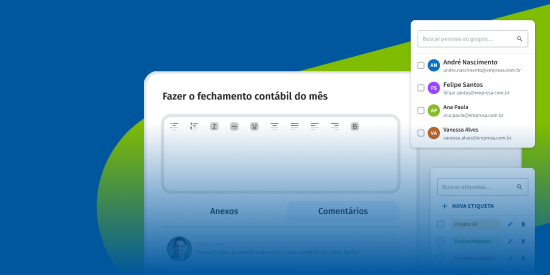

Centralized control

Track the reconciliation of withholding taxes in a unified dashboard, allowing for quick identification and resolution of discrepancies, and maintaining control over tax declarations.

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks