Automate tax account reconciliation

Automate tax account reconciliation, ensuring that calculated amounts and accounting records are aligned with tax obligations.

How does Dattos solve it?

Reconciliation accuracy

Automatically compare calculated taxes with corresponding accounting entries, ensuring all tax obligations are correctly recorded.

Risk reduction

Eliminate manual errors that could result in fines, penalties, or audit issues, ensuring compliance with tax laws and providing greater security in tax management.

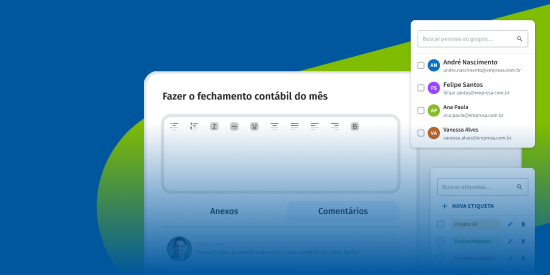

Centralized view

Track the team’s progress and the status of taxes due, payments made, and any discrepancies in real-time. With centralized processes, assign responsibilities, set deadlines, and maintain full governance over tax obligations, facilitating audits and regulatory compliance.

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks