DIRF reconciliation

Automate DIRF reconciliation (Declaration of Income Tax Withheld at Source), ensuring that withheld and declared amounts are accurate and in compliance with legislation. Reduce time spent on manual checks and eliminate inconsistencies in tax calculations.

How does Dattos solve it?

Automation and agility

Dattos automates DIRF reconciliation by cross-referencing withholding tax data with accounting and fiscal records, ensuring all information is accurate and in compliance with current legislation.

Reduction of risks and penalties

The platform quickly detects inconsistencies between withheld and declared values, eliminating the risk of manual errors that could lead to fines or issues with tax authorities.

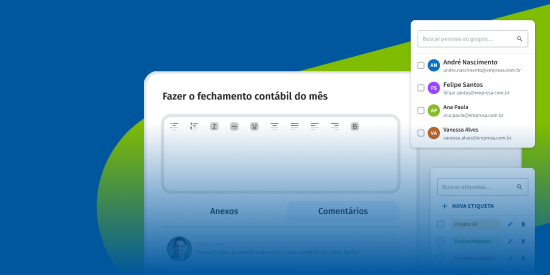

Centralized control

Monitor DIRF reconciliation in an integrated dashboard. Track all withholding and declarations accurately and transparently, ensuring efficient and error-free tax management.

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks