Bank reconciliations

Automate your bank reconciliations and ensure that accounting records are aligned with bank statements. Reduce time spent on manual tasks, quickly identify discrepancies, and ensure more precise and efficient financial management.

How does Dattos solve it?

Reconciliation accuracy

Dattos automates reconciliation between accounting records and bank statements, ensuring that all transactions are properly accounted for. The platform automatically compares inflows and outflows, quickly identifying inconsistencies such as incorrect entries, duplicates, or unrecorded transactions, allowing for immediate adjustments.

Risk reduction

Automating bank reconciliations eliminates the manual errors that can distort financial reports and cause problems during the closing process, preventing delays and penalties.

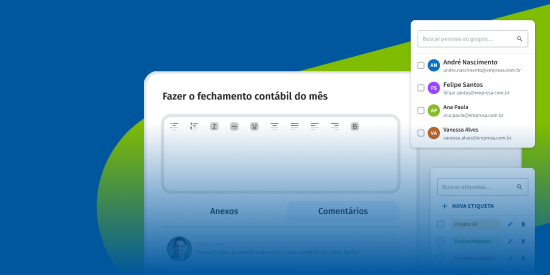

Centralized view

Dattos provides a unified, real-time view of the entire process, allowing managers to track the status of each financial and accounting transaction. The platform centralizes all information, making governance, responsibility assignment, and discrepancy identification easier, increasing transparency over company finances.

Optimize your routine

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks