Accessory obligations: what are the main ones for large companies?

Accessory obligations are declarations of data relating to the company's operations that are submitted to the government on a regular basis. Find out more!

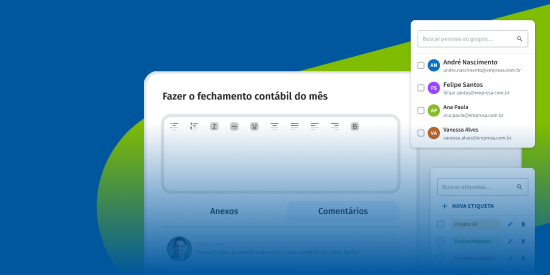

Tax reconciliation: the definitive guide on how to do it

Tax reconciliation: learn how to do it efficiently in this complete guide and save time and resources!

Tax reconciliation: step by step to do it efficiently

Tax reconciliation is the path to efficient tax management. Follow our step-by-step guide and optimize your processes now!

Tax management: what is it and what are the best business practices?

Fiscal management: take a look at good practices to ensure that it is efficient and transparent, reducing costs and fulfilling your legal obligations.

Tax mistakes: which are the most common and how can you avoid them in your business?

Tax mistakes: in this complete article, understand once and for all how to avoid them, maintain compliance and reduce expenses in order to ensure tax compliance!

Tax automation: what are its benefits and why implement it?

Tax automation: understand in practice the benefits of investing in the digitalization of the tax area and learn how to implement it!

LCDPR: what is it, how to do it and what are the deadlines for rural producers?

LCDPR: tax obligation imposed on rural producers, which aims to record all financial transactions related to agricultural activity. Understand!

EFD (Digital Tax Bookkeeping): what is it, what are the penalties and the differences?

EFD (Digital Tax Bookkeeping): understand what it is, its obligations and discover its main components in this content. Check it out!

e-Financeira: how to use cross-checking to your company's advantage?

e-Financeira: understand what it is and how to deliver it. Also, check out how to use it to improve your company's management and performance.

Tax accounting: 9 obligations for large companies

Tax accounting: find out which 9 ancillary obligations are part of the accounting of large companies.