Como fazer a apuração de impostos com precisão?

Tax assessment can be complex, but not with the tips in this post. Find out how to make this process efficient and accurate.

SPED: what it is, how it works and how to transmit it without errors

In this article, understand what SPED is and find out how to transmit your tax obligations easily and without errors.

ICMS: practical guide to impact, calculation and management

In this article, find out all about ICMS, how it affects your company, and how to optimize your management with automation.

How to calculate ICMS-ST?

Calculating ICMS-ST: in this article, you'll learn how to do it effectively, what the tax incentives are in each state and how automation can help.

Tax reform enacted by Congress: understand the tax changes

The tax reform was enacted by Congress on 20/12/2023 and is essential for companies in Brazil. Find out how to adapt your operation!

Tax incentives: why are they crucial for the economy?

Tax incentives: a driving force in the economy. Find out about the main ones and their importance for social and economic development.

Tax obligations: what are the main ones for large companies?

Tax obligations refer to the legal duties imposed on taxpayers by a tax authority. Read the article and find out more!

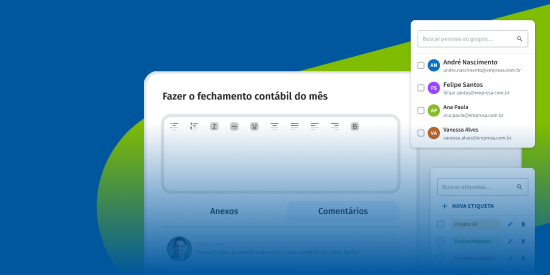

Tax closing: 5 steps to successful completion

Tax closing: learn the 5 essential steps to simplify the process and avoid errors, improving your company's efficiency.

Tax complexity: simplify with automation

Tax complexity: explore how automation can be the key to overcoming tax challenges and boosting your company's growth.

Tax compliance: the practical guide!

Tax compliance needs a series of good practices to be structured assertively in your company's policy. Check out this complete guide!