Tax reconciliation

Automate tax reconciliation, ensuring that all tax calculations and filings are correct and compliant with local, state, and federal tax obligations. Eliminate manual errors and gain control over the tax reporting process.

Reconciliation accuracy

Reduce risks and prevent tax problems with automatic processes for controlling and validating records and obligations, comparing the tax book to the calculation system, ledger and obligations much more quickly. Check movements in accordance with tax regulations to guarantee the organization's security.

Implementation by experts

Our team carries out end-to-end integration, ensuring that all data is captured and processed in accordance with tax regulations. Continuous support from the Dattos team provides security and reliability at every stage of the process.

Save time

Tasks that take days in Excel spreadsheets become tasks completed in minutes, freeing up time for analysis and other financial routines.

Trust the data

We map your entire process and integrate all endpoints. There's no room for error: reliable data, without the risk of manual mistakes, and quick identification of inconsistencies.

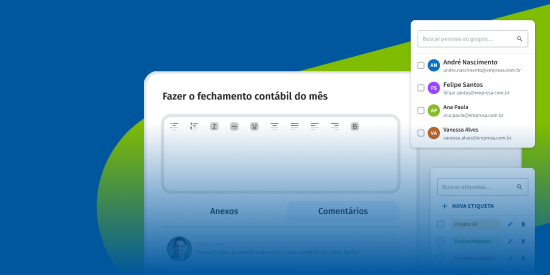

Real-time tracking

Configurable steps, deadlines, and responsibilities enable better task management and team visibility without micromanagement. Everyone stays aligned.

Optimize your routine

Fill in the form below and schedule a demonstration

Ensure more reliable data and reduce time by automating manual tasks