See how COFCO International automated reconciliations for more than 840 accounting accounts, improving efficiency and significantly reducing the manual work of its staff.

Check out some of the multinational's figures

- 10,000 employees worldwide

- 31 billion dollars in revenue

- 106 million tons (turnover)

- 30 million tons (port capacity)

- 24 million tons (processing capacity)

- 2.2 million tons (storage capacity)

- 60% of the world's assets are in South America, the world's largest exporting region

About COFCO

COFCO International is a a Chinese state-owned agricultural company with operations in 35 countries. With US$31 billion in global revenue, it handles 114 million tons of grain a year and has more than 10,000 employees. Headquartered in Geneva, Switzerland, it is a leader in the global supply chains for grains, oilseeds, sugar and coffee.

The multinational is focused on being the world leader in the grain, oilseed and sugar supply chain, with assets in the Americas, Europe and Asia-Pacific. Today, the company negotiates with more than 50 nations, giving farmers direct access to the growing Chinese market.

Objective

In line with its vision of being the world's leading agribusiness supplier, COFCO International had bold goals for expanding its business, which automatically implied increased volume of financial data to be processed by the companies in the group.

The financial operation of a company that is growing on a global scale needs to be precise and effective, and it can't afford any errors or delays. COFCO therefore needed to find a a tool to support the team in managing controls, ensuring the accuracy of information and centralizing and standardizing conciliation processes.

So the initial motivation was to hire a technological solution that would guarantee the quality of financial information and help it manage and analyze the closing processfor reporting purposes to the head office in Geneva.

Challenges

COFCO International did the reconciliations manually using spreadsheets and since there was no solution to formalize the procedures and process this information in bulk

The finance department needed greater control over activities, deadlines and those responsible to ensure that data was delivered on time and that governance was met

Due to its size, the company had different departments responsible for delivering financial data, which at the end of the process had a direct impact on the quality of the information generated

Solution

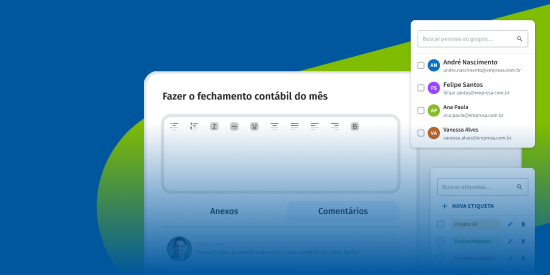

COFCO International needed a reliable partner who could automate accounting reconciliations and manage the flow of account approvals for closing. The company's Shared Services Center needed a a robust solution with functionalities that would allow the team to be more assertive and agile in its processes.

The company therefore implemented a joint project with Dattos to analytical processing of large volumes of financial data. With features such as management dashboards, customized accounting covers, approval control and justifications, as well as the possibility of creating customized data cleaning, processing and matching rules, according to the structure of the current files and/or business rules.

The main results were centralization of closing processes, automation of accounting reconciliations, information quality assurance and transparency for auditing.